From a spatial perspective, there are many factors that affect oil & gas prices, such as the number of fields, mining technology, and endowments. These factors are closely related to the commodity attributes of oil & gas. From a historical perspective, the formation process of international oil & gas prices is complicated. The formation of crude oil prices is not directly affected by certain specific factors. For example, crude oil, as the main support energy for maintaining a country’s economic development, determines the country’s economic development process. Therefore, the imbalance between the demand for and supply of crude oil has become international politics. The key to the game is that this game will inevitably have an impact on crude oil prices. In addition, the influence cycles of various factors on crude oil prices are not consistent, so crude oil prices themselves have obvious nonlinear characteristics.

It can be seen that oil & gas have both commodity attributes and financial attributes. This makes oil & gas prices to exhibit a long-term trend, but also local fluctuations. First, the relationship between supply and demand is the main driving force behind the formation of market prices. Therefore, the impact of supply and demand on is long-term and is also a key factor in stabilizing oil & gas prices. Second, international oil & gas uses the U.S. dollar as the unit of settlement. Therefore, the trend of the US economy and related political and economic activities will inevitably bring about fluctuations in the market. Third, the impact of these financial factors on oil & gas market can only last for a short period of time, causing the prices to fluctuate in the short term in the future, but cannot affect the long-term trend. Finally, the sudden change in the international economic situation has also caused a certain impact on the market, causing temporary fluctuations. Long-term factors and short-term factors work together to make oil & gas prices have significant nonlinear characteristics. Due to these nonlinear characteristics, forecasting oil & gas prices is considered a difficult task.

Traditional forecasting methods often rely on fitting data to a pre-specified relationship between dependent and independent variables, thus assuming a specific functional and stochastic process. In contrast, a different approach to statistical analysis and forecasting, in particular, is offered by machine learning (ML), which is a narrow form of artificial intelligence, often described as the art and science of pattern recognition. Indeed, ML is to a great extent a data-driven framework, since it requires mild assumptions about the underlying statistical relationship in the data.

Producing accurate forecasts is not an easy task, since it requires an approach complex enough to incorporate relevant variables but also focused on excluding irrelevant data. ML methods, in general, are able to deal with large amounts of data (big data) and nonlinear patterns in the data, often hidden to standard linear models, thus offering an alternative and compelling approach to traditional econometric models.

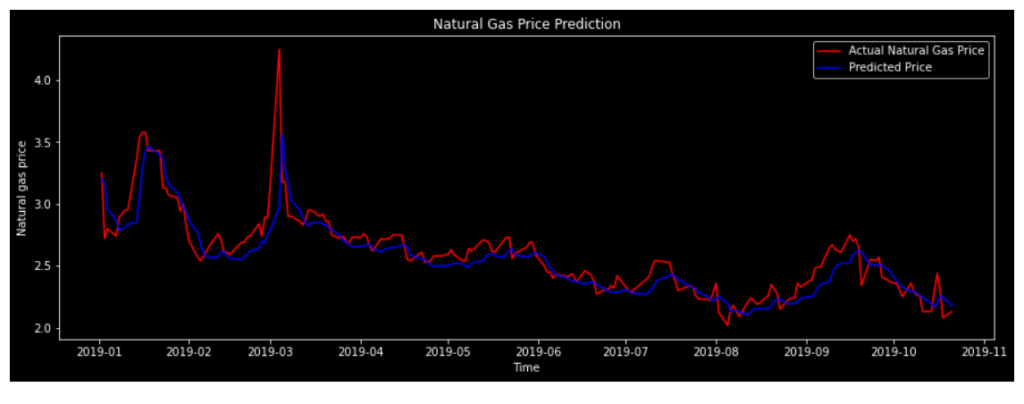

Overall, the results are in favor of the nonlinear automated procedures, indicating machine learning algorithms can indeed statistically surpass traditional models. One of the reasons is the ability of some machine learning techniques in reducing the forecast variance while maintaining the forecast bias under control. As a result, forecast accuracy can be improved when compared to traditional oil &gas price forecasting models.